65% of businesses have renegotiated their lease in the last year—is it time to talk to your landlord?

Stormy economic forecasts, stubborn inflation, and record-high interest rates have led to one of the most turbulent commercial real estate (CRE) markets in years.

And businesses are feeling the impact. Our Capterra survey finds that 74% of organizations report that monthly payments on their main property have risen in the last 12 months.* However, despite rising prices, 81% say they feel their negotiating power in leasing decisions has increased within the last two years, indicating that the current climate might just be the perfect storm for businesses to broker more favorable leasing terms.

With this in mind, we set out to explore how businesses that have already renegotiated their lease went about the process. Identifying the tactics they used to secure favorable terms for their business can help you build a strategy to do the same. We’ll also highlight other ways you can cut property costs so that you’ll be prepared for whatever the CRE market has in store for you in the future.

/ Key findings

74% of surveyed businesses say the monthly payments on their main leased property have increased in the past year.

49% say that they feel CRE prices will increase in the next year, and in preparation, they’ve reduced the amount of space they lease, consolidated their properties, or begun to invest in creating hybrid workspaces.

81% say they feel their negotiating power in leasing decisions has increased in the past two years.

65% have renegotiated their lease in the last year and 43% plan to in the next 12 months.

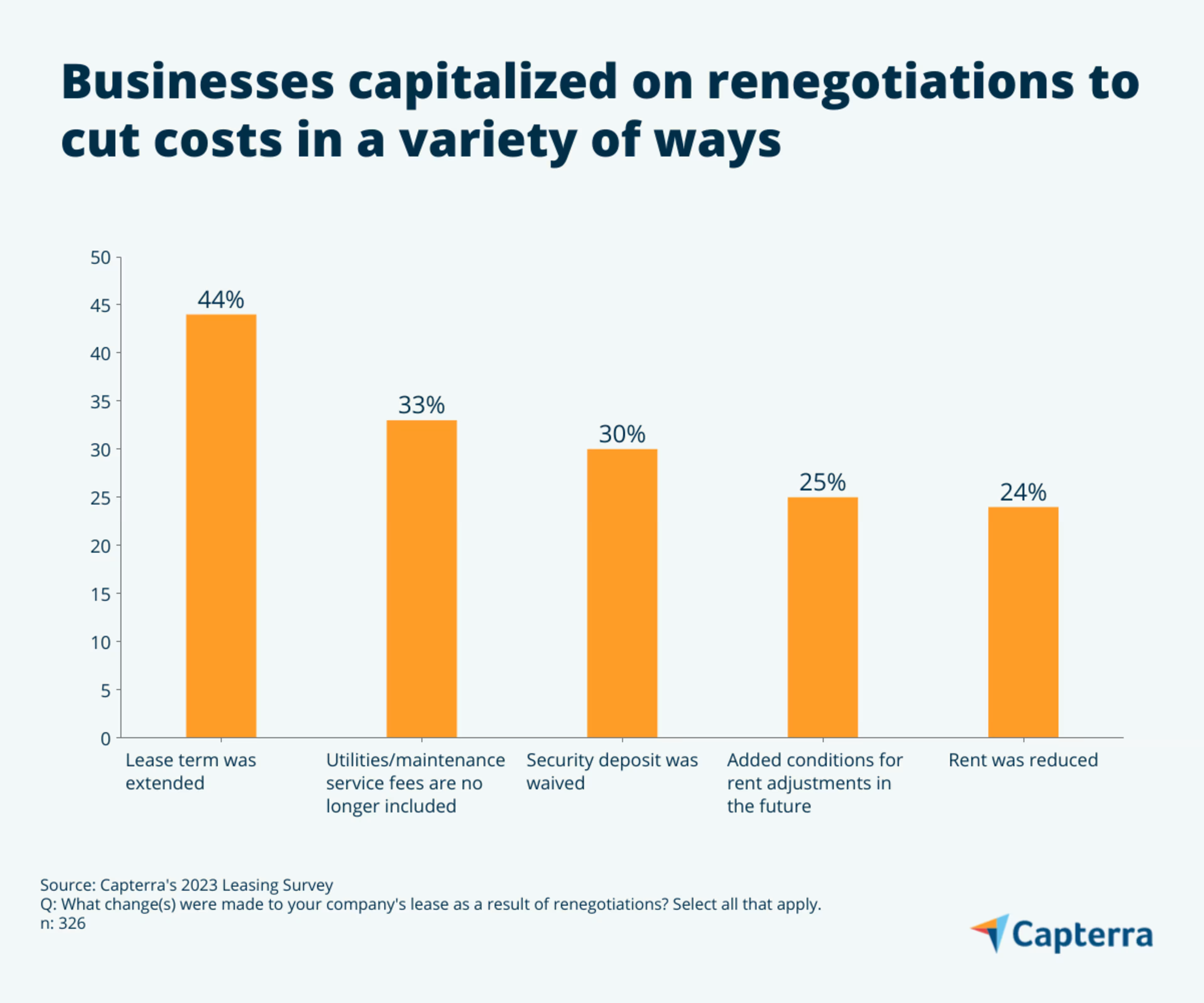

97% say that they are satisfied with their lease after renegotiating. The top changes they report are geared toward cutting costs, including removing utilities/maintenance fees, reducing rent, and adding conditions for rental adjustments in the future.

Rising real estate costs consume budgets, prompting businesses to take action

A majority of businesses currently lease property to be used as office or retail space. However, a third of companies say they’ve been leasing mixed-use space, enabling them to bundle office, commercial, or industrial needs all into one facility. Most companies have an average of three properties under lease.

Almost three-quarters of respondents (74%) say that their monthly payments on their main property have increased in the last year. In 2022, 38% of businesses spent between $250K to $500K on leasing costs alone.

Looking to 2023, these expenses are cannibalizing a large percentage of organizations’ planned spend and the turbulent future of the CRE market means that increasing prices will likely continue to take a heavy toll.

In fact, nearly half of businesses (49%) feel that CRE prices will continue to rise well into 2024.

As a result of these increased costs, more than half of businesses (53%) have consolidated office space and a little less than half (47%) have made investments to create hybrid workspaces. Other ways businesses have saved on property costs include reducing the amount of space they lease, relocating to a less-expensive area, or subleasing—which is an option only 23% have explored.

/ Analyst's insight

Why are leasing rates increasing?

Landlords are struggling as well, and looking for ways to recoup on property value, avoid mortgage delinquencies, and evade the potentially unfortunate reality of giving the keys back to lenders. A substantial amount of office space in the U.S.—more than 20%—sits vacant. Coupled with interest rates that have swiftly increased over the past few years, and the risk of plunging property values, landlords find themselves in a precarious financial situation.[1] One way property owners are weathering these economic headwinds is to raise leasing rates, passing the cost along to tenants.

In order to save, businesses are renegotiating leasing responsibilities, clauses, and costs

Unlike temporary measures offered by landlords such as rent forgiveness or waiving late payment fees during times of economic strain, renegotiating leasing terms can be a long-term solution for businesses looking to cut property costs.

Adjusting the terms of their lease can help companies deal with some of the top cost-related challenges associated with leasing, such as operating expenses or high monthly payments.

Unfortunately, since the onset of the pandemic, only 27% of businesses say that their landlord initiated conversations to restructure their contract.

Most organizations are under full-service, net, or modified gross leases—contract types that, due to the way responsibilities and property costs are divided between landlord and tenant, are commonly subject to negotiations. Landlords determine, manage, and charge for operating expenses under a full-service lease, for example. If a business switched to a net or modified gross lease, they can potentially lower base rent, alongside other costs, in exchange for shouldering additional responsibilities.

Contract type | How it works |

|---|---|

Full-service lease | The tenant pays one all-inclusive rental rate which includes both the base lease rate and operating expenses. |

Net lease | The tenant pays a portion or all of the taxes, insurance fees, and maintenance costs for a property in addition to rent. |

Modified gross lease | In addition to their rent, the tenant works with the landlord to pay ongoing expenses associate with the property. |

Percentage lease | The tenant pays base rent along with a portion of their sales revenue. |

Sublease | The tenant leases all or a portion of their lease space to another party, making the original tenant a sublessor. |

Ground lease | The tenant leases land from the property owner and constructs their own building or uses the land for a specific purpose. |

Build-to-suit lease | The tenant works with a landlord to design and construct a building customized to the tenant's requirements, which they lease after completion. |

Under a net lease, for example, tenants have the flexibility to choose service providers for property maintenance and repairs—giving them the chance to seek competitive bids and potentially lower maintenance costs. More direct control of handling property taxes or insurance premiums gives businesses more transparent insight into overall costs, which can help them with financial planning.

There's no time better than now for businesses to open up the conversation with their landlord —81% of respondents say that they feel their power in leasing negotiations has increased within the last few years. In the next year, 43% of businesses plan to renegotiate their lease and nearly two-thirds already have within the last year.

In fact, 97% of businesses that renegotiated their lease were satisfied with their new terms. Though there isn’t a set of one-size-fits-all adjustments businesses can make to their lease, looking at the most common changes other companies made can be a compass to guide you in the right direction.

Many of the adjustments address factors that influence short- and long-term costs such as removing utilities fees and adding conditions to adjust rent in the future. The most prominent change businesses made to their contract is extending the length of their lease, which can be a concession that can greatly increase a business’s ability to negotiate for other favorable terms, such as reducing rent.

Empty offices are a landlord’s worst nightmare—here’s how to use this to your advantage to broker better lease terms

The start of this fiscal year was rough for landlords. For the third consecutive quarter, office leasing volume fell in Q1 of 2023.[2] In tandem, CRE vacancy rates increased to an all time high of 13%.[3] The worst possible scenario for landlords is vacant space—and finding (or retaining) credit-worthy tenants for long-term leases is becoming harder than ever.

Under these circumstances, now is one of the best times for your business to negotiate your lease with your landlord to secure more favorable terms. The following tactics will ensure you enter into negotiations empowered and aware of what changes your business needs in order to cut costs.

Reassess your need for space

Before you enter into formal negotiations, consider if you have too much, too little, or no need for space. One of the biggest influences on the CRE market has been the rise of hybrid and remote work, prompting many businesses to re-evaluate if office space is a necessity or a sunk cost. Many companies are overpaying for space they’re underutilizing, so downsizing or right-sizing your property can help you save on square-footage costs. You can also optimize space by working with your landlord to sublease, or explore opening up your lease with a co-tenancy clause.

Weigh the eternal question of time

Before negotiating, you need to decide if your business is open to decreasing or increasing the length of your lease. Landlords are hungry for reliable, credit-worthy tenants that provide guaranteed cash flow, making committing to a longer lease one of the best ways to get them to make concessions. Shortening your lease can be helpful if you’re moving properties and can help you avoid paying to break the contract, but it can weaken your bargaining power and will likely bump rent up until your contract ends.

Leverage market research to get the lay of the land

Arming yourself with accurate market data increases your business’ negotiating power. Although the terms, price, and original square footage you committed to when you initially signed your lease might’ve been advantageous, this might not hold true today. Findings can be used to set benchmarks, justify demands, and to also identify alternative properties which might stoke the competitive fire in your landlord’s eyes.

Explore outside financing to cover costs or renovations

Though qualifications and conditions vary based on your industry and other factors, applying for government grants, loans, or emergency assistance funding can lead to subsidized rent, tax breaks, or property improvements that can reduce overall costs for both you and your landlord.[4] Strategically sharing that you qualify for financing can lead to a more collaborative and productive negotiation process, as landlords are more inclined to offer concessions or favorable terms knowing that your business is financially stable and reliable.

Level the playing field by working with a tenant rep or CRE lawyer

It’s never just negotiating with your landlord—they have brokers and lawyers on standby to represent their best interests. It’s critical that you work with a tenant representative or CRE lawyer to level the playing field. The cost of hiring these professionals is offset by the potential savings, favorable terms, and reduced risk that they can help your business achieve, and their assistance ensures that you have a safeguard that can navigate the complexities and legal ramifications that come with negotiating your lease.

The power is in your hands—don’t let it go to waste

Given the future of the CRE market and rising prices, it’s important that your business seize the opportunity to renegotiate your lease. Landlords are more willing than ever to enter into conversations, and coming to the table with market research and a clear understanding of your business’ property needs will increase the leverage your business has to negotiate for the best possible terms.

Managing leasing documents, keeping up with associated property costs, and getting ready for negotiations is anything but simple. You need a plan in place—one that covers both the short and long-term. If your business hasn’t already outlined a financial plan for the coming year, it’s crucial that you create one. Consider working with a financial professional to identify areas your business can cut costs in light of the CRE market’s tumultuous state.

Accounting firms can also help you create safeguards to mitigate financial risk and their assistance in optimizing your annual budget plan can better prepare you for leasing negotiations by identifying clauses or contracts you can tweak to weather whatever storm the CRE market sends your way.

Are you interested in finding an accountant to help you navigate the budgeting process, including your lease payments? Check out Capterra's list of top-rated accounting firms and our hiring guide to help you choose the best financial professional for your business's needs.