Learn from other buyers’ budgets, feature needs, and pain points to aid your construction software search.

Sixty percent of small and midsize businesses (SMBs) report purchase regret over a recent technology purchase, according to our 2024 Tech Trends Survey.* Your business doesn’t have to be one of them.

Each year, Capterra’s advisors speak with thousands of software purchase decision-makers evaluating new construction software for their businesses. We’ve mined those conversations for insights on other small businesses’ budgets, feature needs, and pain points to aid your own software search.

/ Key insights

Buyers seek the estimating feature, but users rate accounting as the most critical.

Businesses primarily find specialized tools tailored for specific functions, such as Digital Blueprints, Microsoft Access, and PDF Digital, to be highly convenient for their daily construction operations.

Buyers switch to new construction software so as to enhance efficiency, improve functionality, and user-friendliness.

Buyers are willing to spend, on average, $1,600 - $4,000 per year on construction software.

Buyers seek estimating features, but users rate accounting as most critical

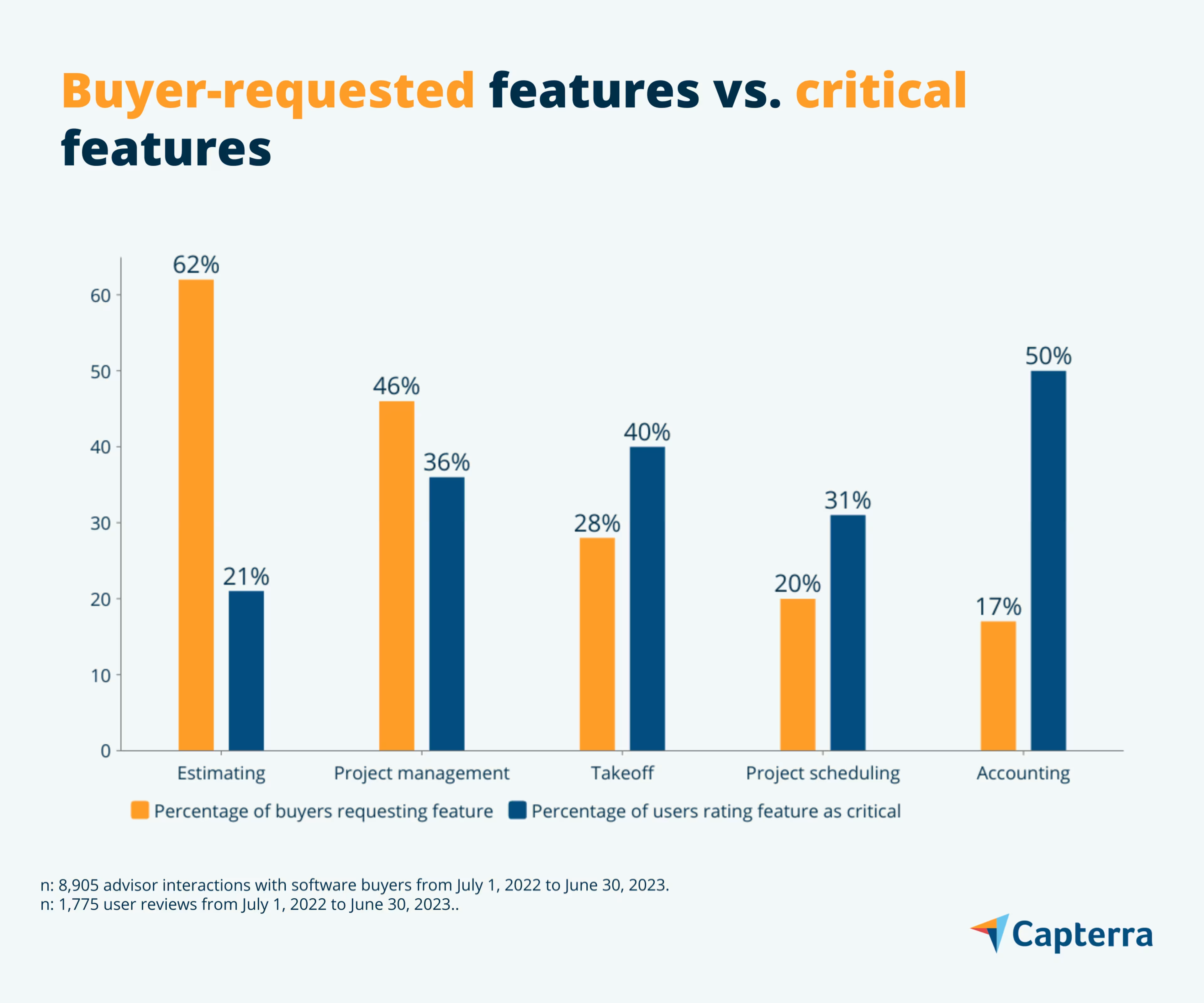

When businesses evaluate new construction software, their primary focus is often on essential features such as estimating, project management, takeoff, project scheduling, and accounting. These functionalities are crucial for efficiently managing construction projects, budgeting, and overall business operations. However, a comprehensive understanding of user preferences is essential to ensure that the chosen software aligns with the specific needs of construction professionals.

To gain insights into user preferences, we analyzed thousands of construction software reviews available on Capterra to identify the features that construction software users consider most critical for their daily work. Interestingly, our findings revealed a discrepancy between the priorities of construction software buyers and users. While estimating emerged as the most-requested feature from buyers during the software selection process, accounting ranked as the most critical feature according to actual users.

The misalignment between buyers' and users' preferences is most prominent in estimating functionality. Users are valuing accounting more and estimating less due to the growing need for financial accuracy, cost control, risk mitigation, and compliance. Robust accounting features help manage complex projects, maintain financial transparency, and make data-driven decisions, all of which are critical in a modern construction environment marked by complexity and heightened client expectations. This finding indicates that businesses that are already using construction software recognize the immense value of robust accounting features in streamlining financial management and optimizing project profitability.

These insights carry significant implications for businesses seeking to invest in construction software. While estimating, project management, and other features are undoubtedly vital, accounting functionalities play a pivotal role in meeting the financial and operational demands of construction projects. Proper accounting capabilities enable precise tracking of expenses, seamless integration with project management processes, efficient payroll management, and compliance with industry-specific financial regulations.

Pro tip: Tailor required software functionality to meet your construction team's specific needs, as data shows varying opinions on critical features for different businesses. Identify your unique requirements rather than simply listing general features. For example, a residential construction company might prioritize efficient project bidding and cost estimation tools to win competitive bids and maximize profits.

Businesses find functionality-specific tools convenient for day-to-day construction operations

When our advisors asked buyers what methods they were currently using to handle their construction needs, 45% of buyers continued to use functionality-specific software such as Digital Blueprints to handle construction drawings, Microsoft Access to manage crucial data such as material inventories and equipment records, PDF Digital to view and review plans on various devices, and spreadsheets to organize and manage project data and perform calculations.

While these software tools serve specific purposes and are valuable for their respective functions, dedicated construction management software is crucial for integrating and managing all these tasks cohesively.

For example, many businesses use a comprehensive construction management software solution to combine disparate segments of project management into a centralized interface while streamlining day-to-day operations including document management, workflows, punch lists, and task assignments. Furthermore, it has accounting capabilities to track project and job costs, manage payroll, and handle inventory. This integrated approach ensures seamless communication and collaboration between different teams, reduces data duplication, enhances project visibility, and improves overall efficiency in construction projects. Additionally, dedicated construction software helps streamline operations, eliminates the need for multiple disjointed tools, and provides a holistic solution for handling all construction-related processes efficiently.

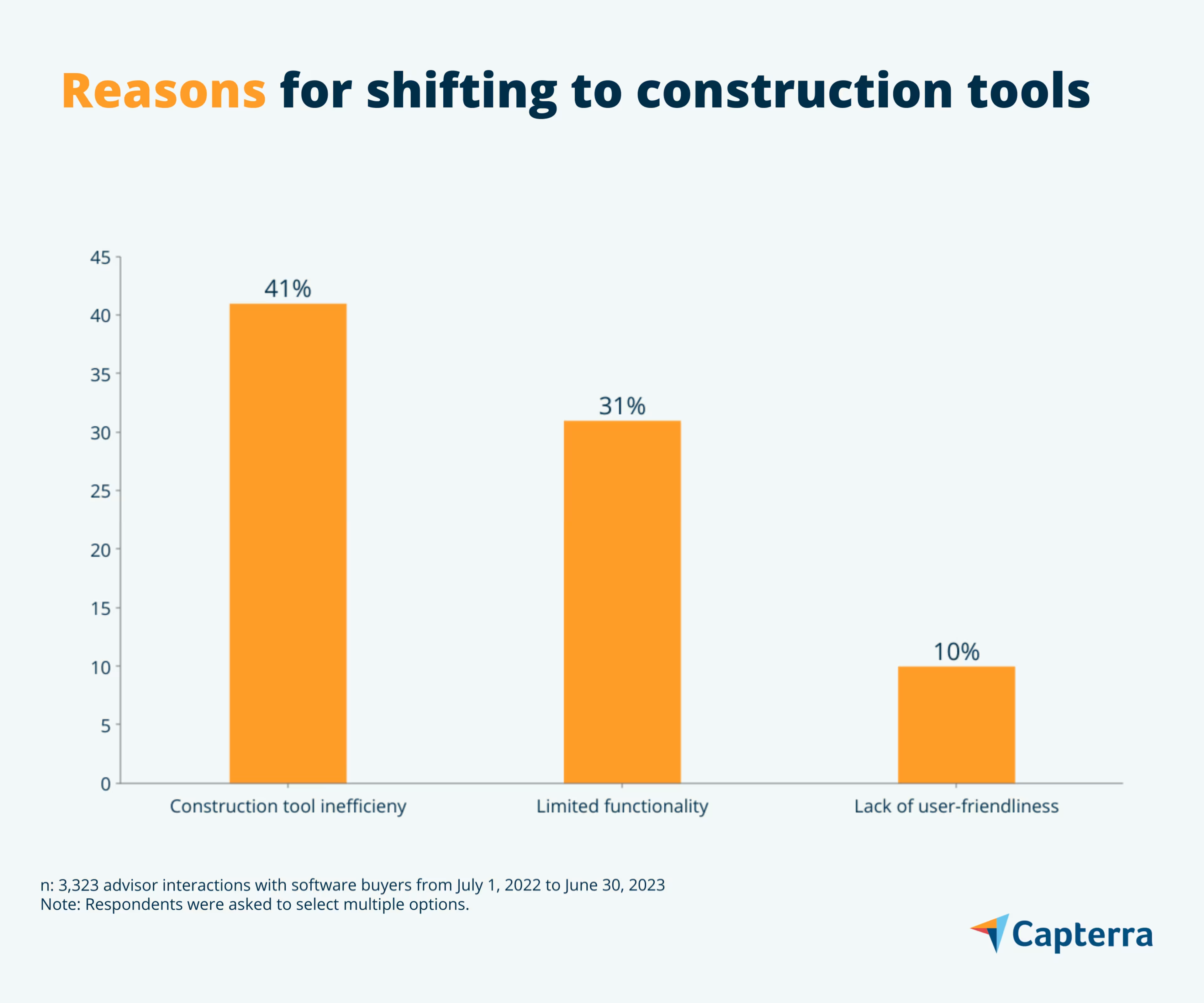

Enhanced efficiency, better functionality, and user-friendliness drive users to switch to new construction software

Our advisors engaged in conversations with software buyers, approximately 41% of currently using construction software desire to replace their current system. These discussions shed light on the real-life challenges that businesses are facing with their existing tools. Additionally, buyers highlighted the three significant pain points for their dissatisfaction: inefficiency (41%), limited functionality (31%), and lack of user-friendliness (10%).

Inefficiency: Construction projects often have tight deadlines and require efficient coordination among different teams. If the construction software is inefficient, it might cause delays in accessing critical project data or slow down communication between project managers and on-site teams. For instance, imagine construction software that lacks real-time synchronization between the office and the field. Project managers need to manually update progress reports, and on-site workers struggle to access the latest plans and changes, leading to miscommunication and rework. This inefficiency can cause delays in construction timelines and hinder project coordination.

Limited functionality: Construction projects involve various complex tasks, from managing blueprints and scheduling to resource allocation. If the software lacks essential functionalities needed for specific construction tasks, users may need to rely on multiple tools to complete their work, leading to data fragmentation and confusion. For example, scheduling not connected to a messaging system could lead to potential delays when a project manager reschedules the task and the changes aren’t automatically communicated to the team.

Lack of user-friendliness: In the construction industry, the software is often used by a wide range of professionals, including project managers, architects, engineers, and construction workers. Therefore, quick access to project information is essential. Suppose the software's mobile app is not user-friendly, requiring complex navigation to find critical documents or blueprints. In that case, workers might struggle to access information on the go, leading to delays in construction tasks and potentially compromising safety if essential instructions are not readily available.

Pro tip: Before making your final purchase decision, look for free trials or setup demos to see if it helps alleviate the pain points you need to resolve with your new software. With a free trial, you’ll be much more informed and equipped to go into a demonstration with a vendor to maximize the information you can get.

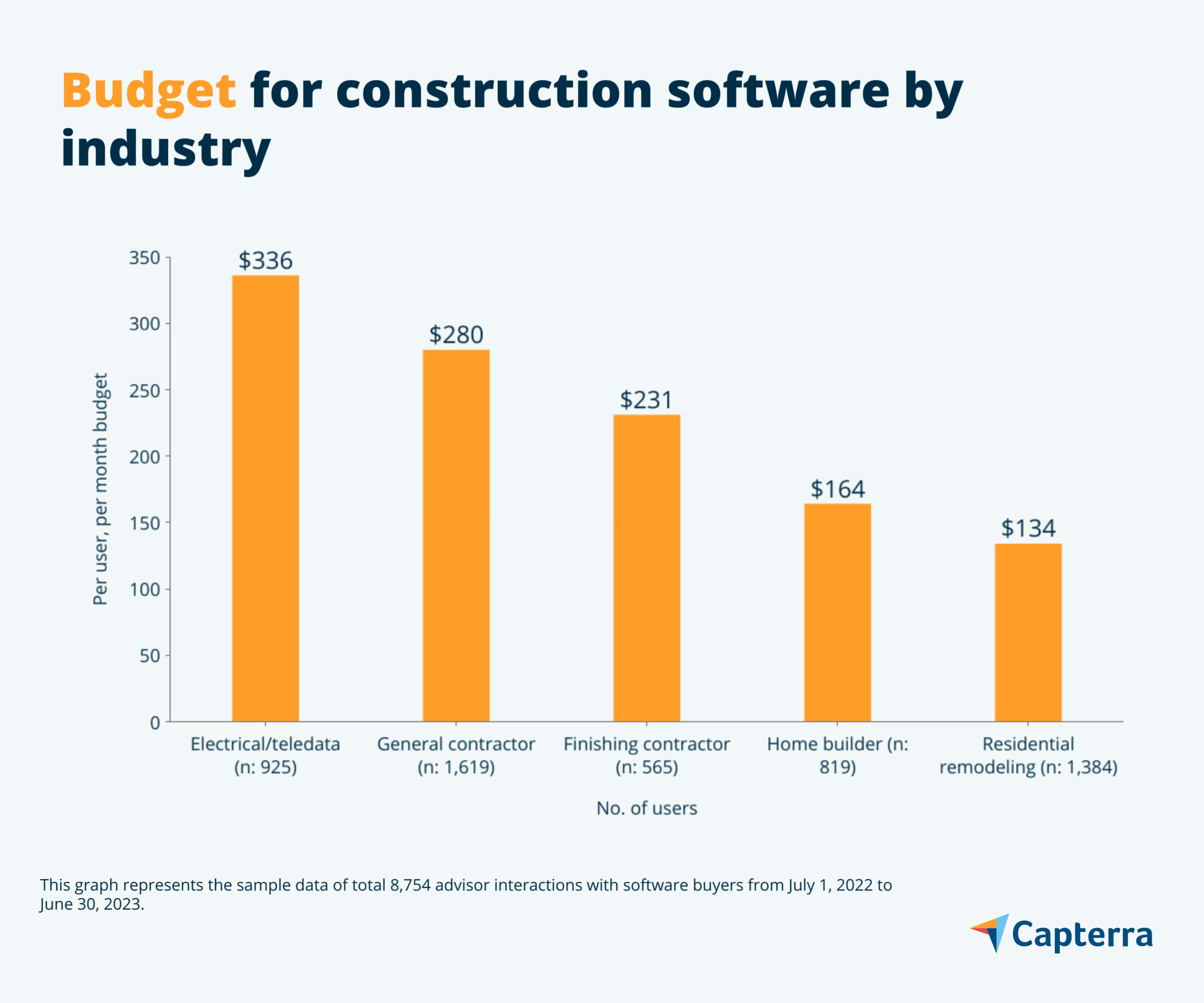

Average buyers’ budgets range from $134 to $336 per user, per month

The budget for purchasing construction software varies from one segment to another based on factors such as organization size, the number of users, and the specific features and functionalities required.

However, the overall average budget businesses are willing to pay approximately $3,300 per user, per year.

The chart below highlights the average buyer budget per user, per month for the top five industries interested in construction software.

Electrical contractors focus on installing and maintaining electrical systems in buildings. Their average budget might be influenced by factors such as the complexity of electrical installations, specific safety regulations, and the types of projects they undertake.

General contractors oversee and manage construction projects, coordinating various subcontractors and ensuring the project's smooth execution. Their average budget could be based on the size and complexity of the projects they handle. Large-scale commercial projects may require significant resources and a higher budget compared to smaller residential projects, leading to differences from the overall average.

Similarly, finishing contractors specialize in interior work, such as painting, flooring, and carpentry. Their average budget may be influenced by the materials used, the level of customization required, and the complexity of the finishing tasks.

Home builders construct new residential properties, and their average budget can be affected by factors such as the location, size, and quality of materials used. Building homes in upscale neighborhoods with luxurious features might lead to a higher average budget for this segment compared to average construction costs.

Residential remodeling contractors focus on renovating existing homes. Their average budget could be influenced by the extent of renovations and the types of refurbishments requested by homeowners.

Pro tip: Before deciding on an appropriate budget, take time to evaluate the true cost of your purchase. You should also negotiate your service-level agreement (SLA) with your vendor early on to avoid being caught off guard by any hidden fees later on.

More resources for your software search

Whether you’re looking to buy new construction software or replace your existing tool, here are some additional resources to aid your software search:

Start with our interactive construction software directory to compare hundreds of products, filter your search by specific features, and read comprehensive reviews from SMB leaders.

Check out top-rated construction software based on user ratings and popularity in the 2023 Construction Management Software Shortlist.

Review our price comparison guide for construction software and construction management software buyers guide to compare tools and better understand the market.

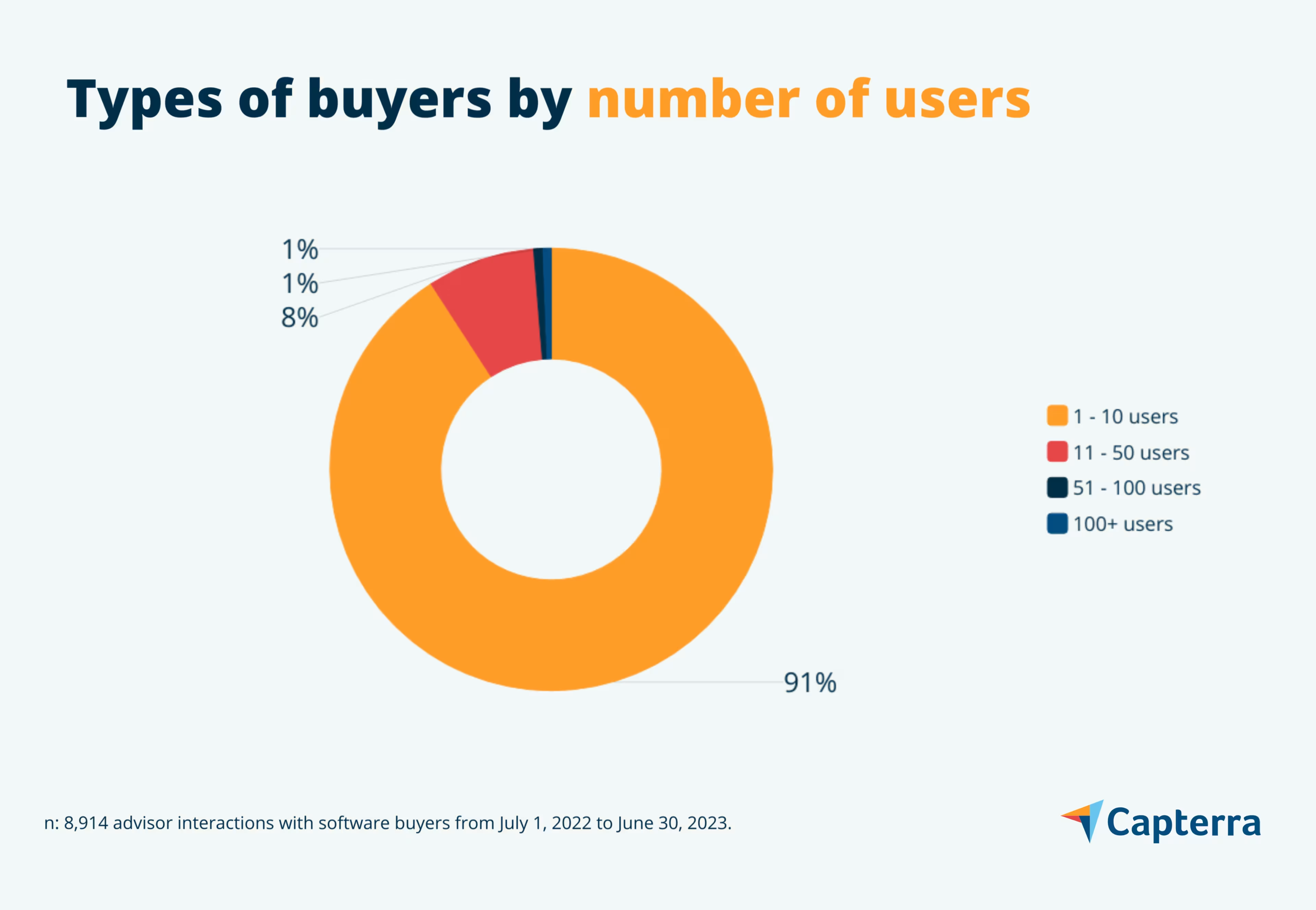

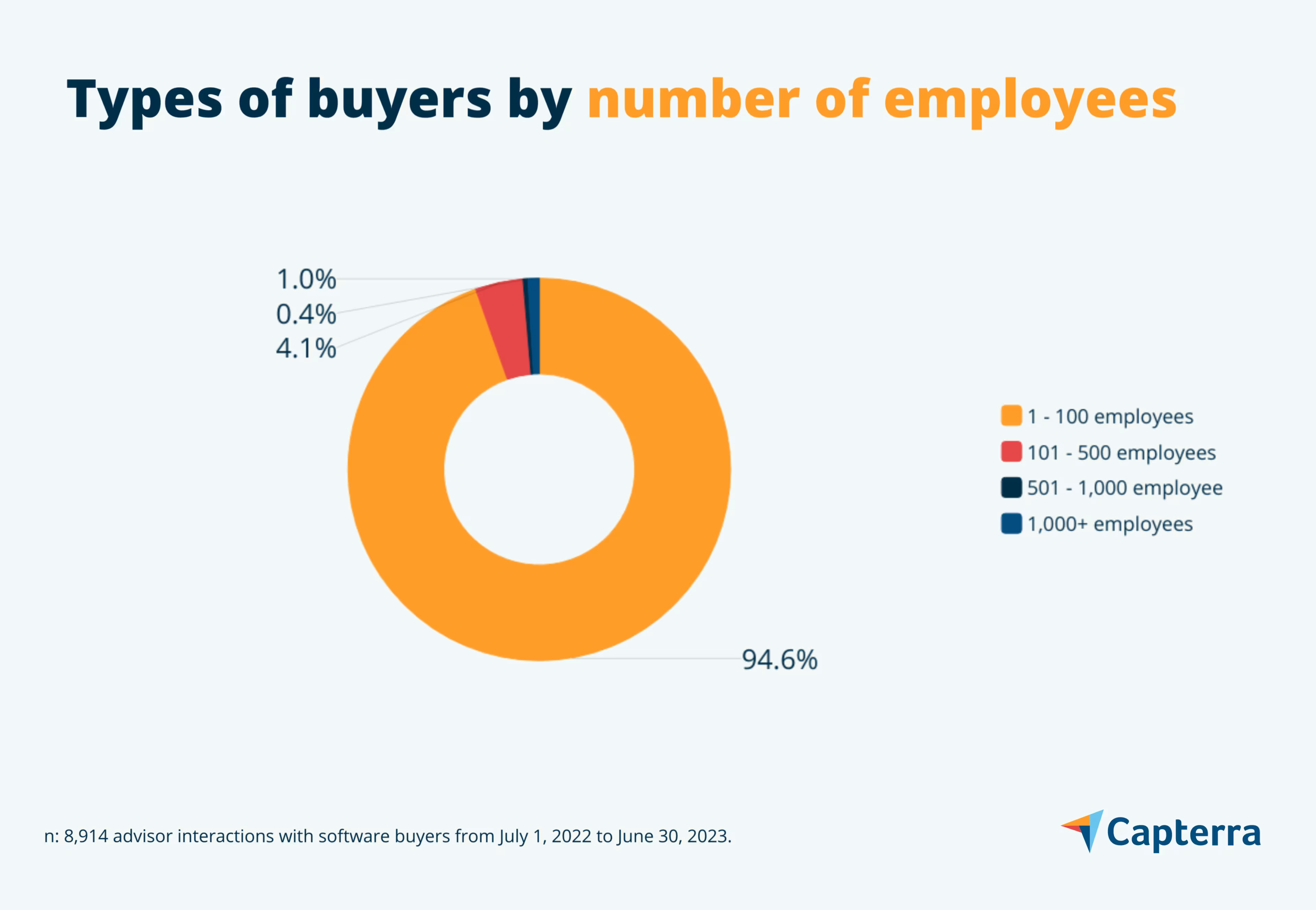

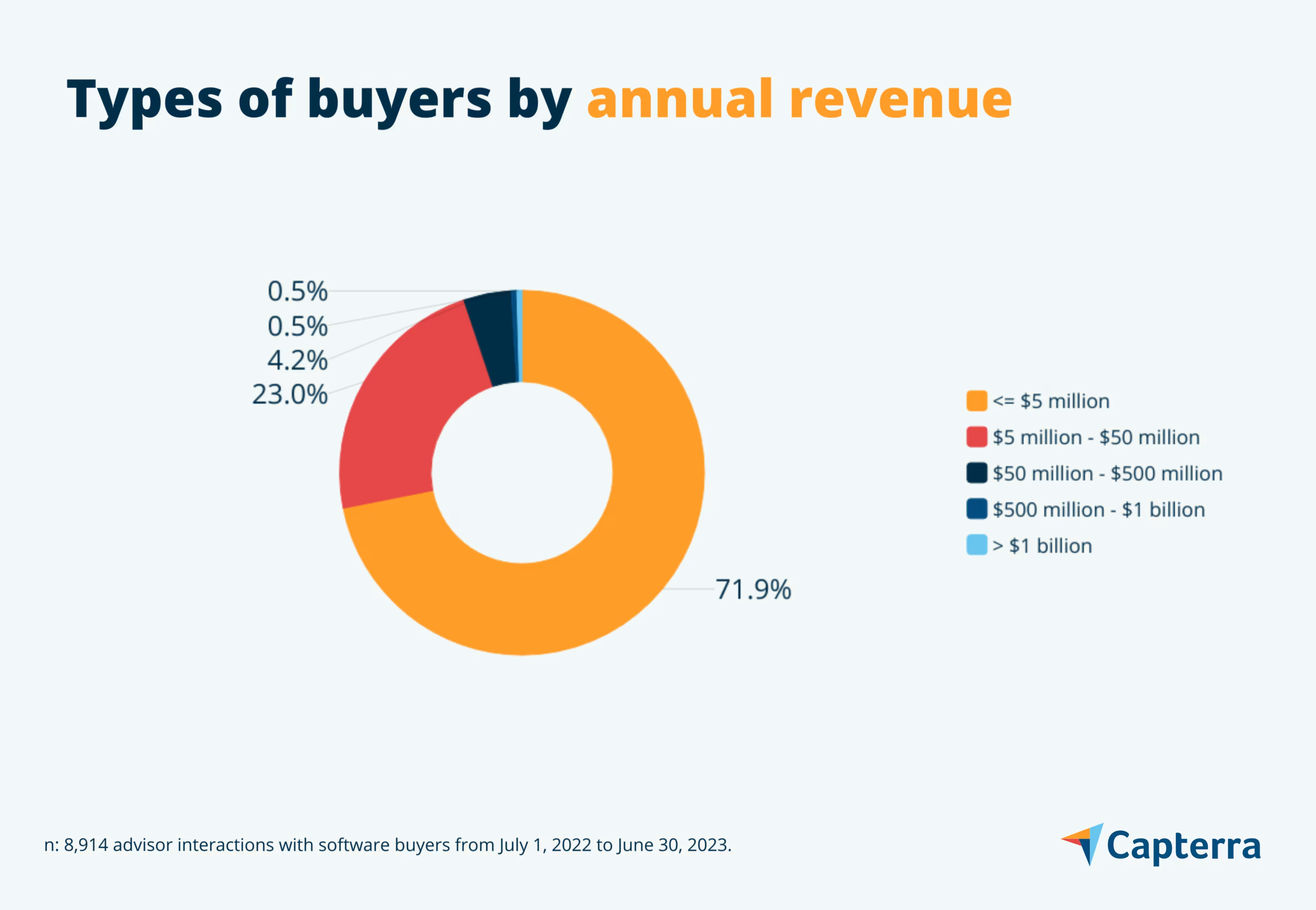

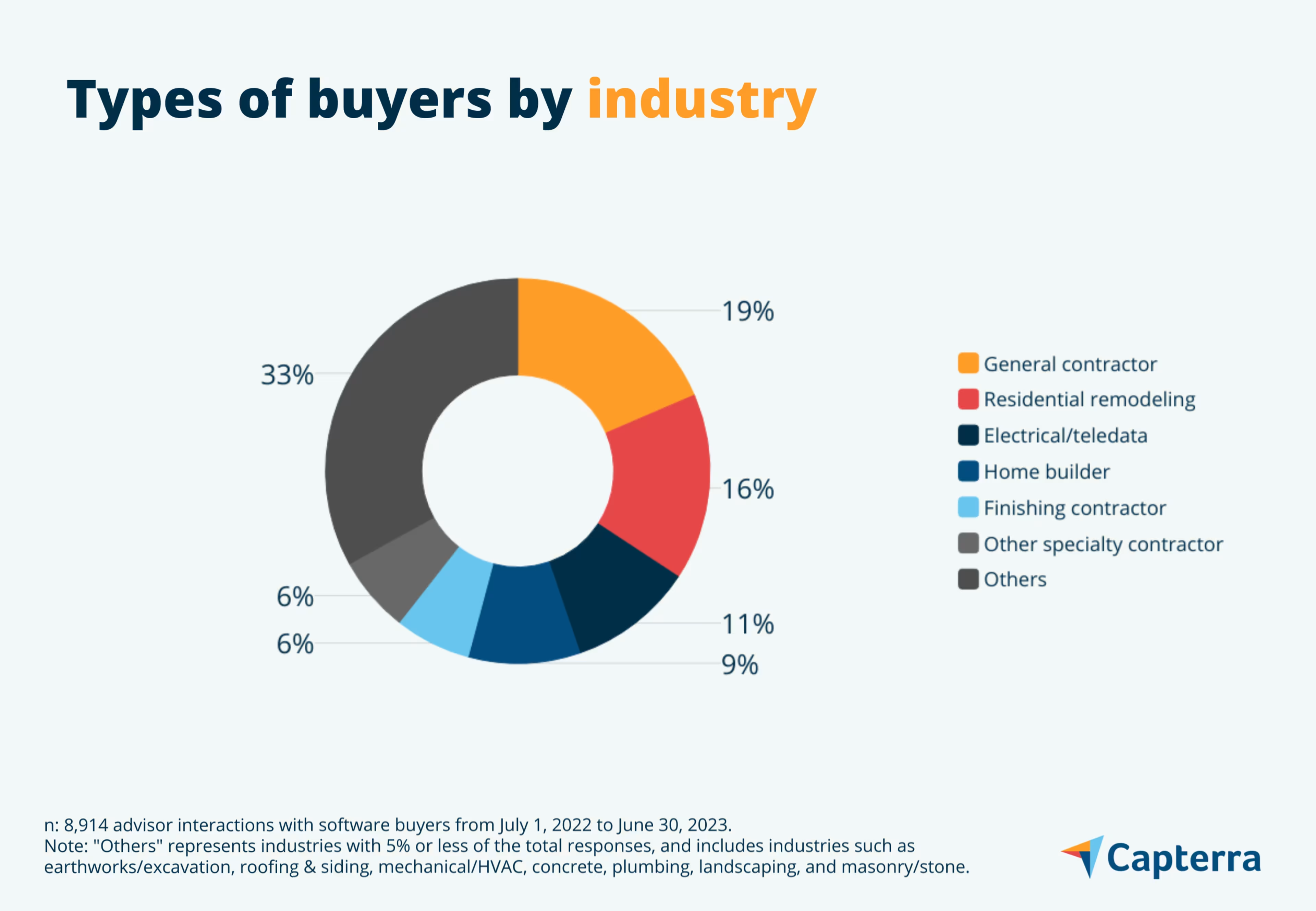

Buyer demographics

The buyers we interacted with are largely small businesses. You’ll find the demographics of the buyers below, so you can see the sizes and types of businesses, from annual revenue to industry.